May 20, 2025

Crypto Payments in El Salvador: How Local Businesses are Leading the Adoption

Explore how local businesses in El Salvador are turning crypto into everyday payments

El Salvador’s move to integrate digital assets into its financial system marked a significant shift toward payment innovation. While the legal framework has since been adjusted, the broader effort to expand financial inclusion through digital infrastructure continues.

Today, that vision is visible on the ground: across tourism hubs and urban centers, more merchants are accepting cryptocurrency as a form of payment drawn by lower fees, faster settlement, and greater access both for underserved citizens and international tourists. Supported by a relatively open regulatory framework, government-supported infrastructure, and a digitally engaged population, El Salvador remains a leading environment for the real-world integration of blockchain-based payment systems.

Why Crypto Adoption is Gaining Ground

One of the strongest motivations for businesses to accept crypto payments is financial efficiency. Traditional payment processors typically charge between 3% to 5% per transaction, significantly impacting profits, especially for small businesses and startups. Cryptocurrencies, by comparison, generally incur much lower fees making them an attractive alternative. In El Salvador, where micro and small enterprises account for the vast majority of businesses, reducing transaction costs can be especially impactful for business sustainability and growth.

Moreover, cryptocurrency transactions can be processed swiftly and securely, bypassing many of the limitations associated with traditional banking. Settlement times are reduced from several days to mere minutes or even seconds, providing crucial liquidity for small businesses operating on tight margins.

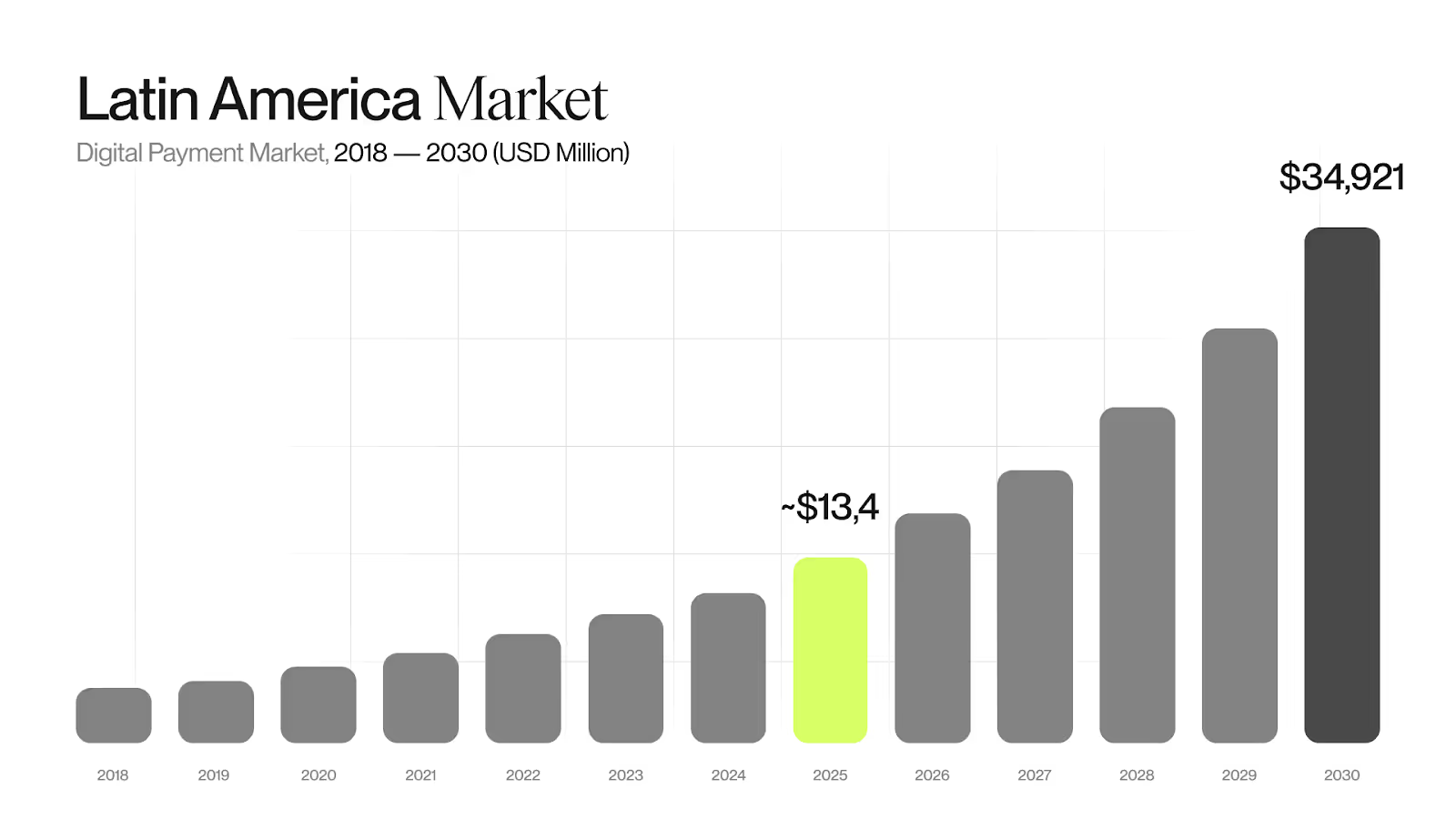

This rise in interest is not unique to El Salvador but part of a broader Latin American shift toward digital payments. In Brazil, for example, in 2024, local major providers processed up to 64 billion transactions, marking a 53% year-over-year increase. This surge underscores Pix’s rapid adoption and its role in transforming Brazil’s payment landscape. Meanwhile, Argentina saw digital wallets overtake credit cards in e-commerce for the first time in 2024, capturing nearly 50% of all transactions.

Regionally, the embrace of digital payments is even more apparent among small businesses. A 2024 survey found that 92% of small businesses across Latin America now accept digital payment methods, a trend that reflects growing consumer preference for electronic transactions and points toward lasting structural change.

Local Businesses Embrace Crypto

In coastal regions like La Libertad, popular among international tourists and locals, several businesses have enthusiastically adopted cryptocurrency payments, particularly through the NAKA Payment Network. Notable among these is Acantilados Hotel, an upscale establishment that caters to international travelers attracted by the convenience of crypto payments via NAKA. Visitors from abroad no longer need to exchange currency or pay high international fees, enhancing their overall travel experience.

Nearby, trendy beachfront spots such as Kaiblue have also joined this financial evolution. Kaiblue's clientele, predominantly younger and tech-savvy, finds crypto transactions appealing for their simplicity and security. The NAKA Card enables seamless and direct payments, further reinforcing the venue’s forward-thinking image.

Similarly, El Xolo, renowned for its fusion cuisine, leverages NAKA Card payments to attract both crypto-enthusiasts and those curious about the technology.

In San Salvador, the capital city, establishments like King's Gastrobar and others have integrated cryptocurrency payments through NAKA to cater to a growing market of digital currency users. Beyond these high-profile venues, crypto acceptance has quietly spread to various cafes, boutique shops, surf rentals, and even small market vendors across the country. These smaller businesses are increasingly recognizing the appeal of crypto-friendly payment options, which offer added flexibility for customers and align with evolving consumer preferences.

Stablecoins and Economic Stability

Another noteworthy trend contributing to the popularity of crypto payments in El Salvador and the broader region is the rise of stablecoins. Platforms reported that stablecoins accounted for 39% of all crypto purchases in 2024, up from 30% the year before. This growth reflects increasing consumer demand for dollar-pegged assets as a hedge against inflation and currency devaluation, a reality faced by many Latin American economies.

The relocation of Tether’s headquarters to El Salvador further highlights the country’s positioning as a hub for stablecoin innovation and digital asset services. For a country that receives over 24% of its GDP from remittances, these developments have strong implications: stablecoins offer a way to receive cross-border payments with lower fees, faster settlement times, and greater reliability than traditional money transfer services.

El Salvador’s cryptocurrency market revenue is projected to reach $3.3 million in 2025, a modest but significant figure considering the country’s size and the relatively nascent stage of its crypto economy. Continued progress will rely on user-friendly solutions and trust-building initiatives by private sector players and fintech platforms.

Overcoming Initial Challenges

The early stages of El Salvador’s crypto journey were marked by challenges, notably technical issues surrounding the government-backed Chivo wallet and resistance from traditional financial institutions. However, private-sector innovations have steadily overcome these barriers, providing more reliable and user-friendly solutions.

Businesses adopting platforms like NAKA, known for its user-centric, decentralized payment network, have reported smoother integration experiences. NAKA’s system allows for seamless compatibility with existing POS systems without additional hardware or extensive training, significantly lowering the barrier to entry for merchants hesitant about embracing new technologies.

The Road Ahead

El Salvador’s crypto payments revolution is still in its early stages, but the signs of sustainable growth are evident. The expansion of crypto acceptance among local businesses is driven by genuine practical benefits such as cost reduction, faster transaction processing, enhanced financial security, and increased customer engagement.

For businesses in El Salvador, this moment expands digital opportunities. Through a single platform, NAKA POS enables merchants to accept stablecoins, Bitcoin, Lightning payments, and other digital methods, creating more flexibility for local and international customers. Full details on supported payment methods are available here.

As adoption grows, cryptocurrency and digital payment systems are positioned to strengthen the nation’s economic fabric and advance financial inclusion.

In conclusion, El Salvador’s experience highlights the transformative potential of cryptocurrency when adopted organically by businesses and consumers alike. Driven by practical benefits rather than regulatory mandates, this organic adoption positions the nation as a compelling case study for global crypto integration.

Share this post